Designed for small importers.

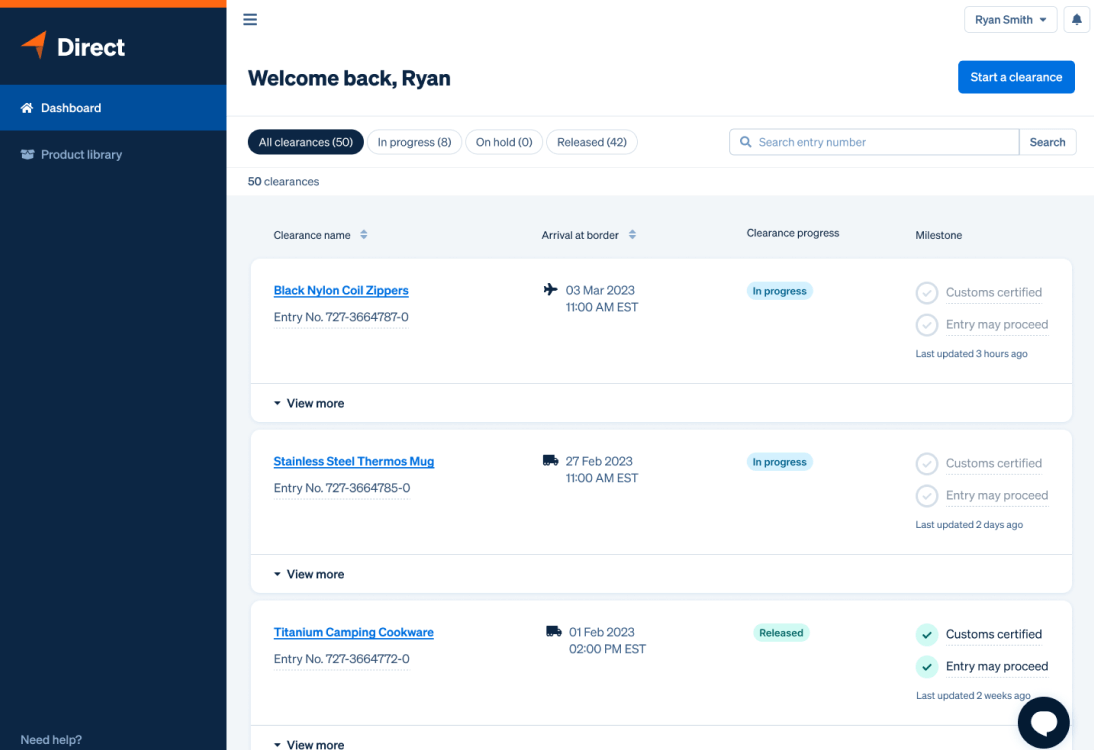

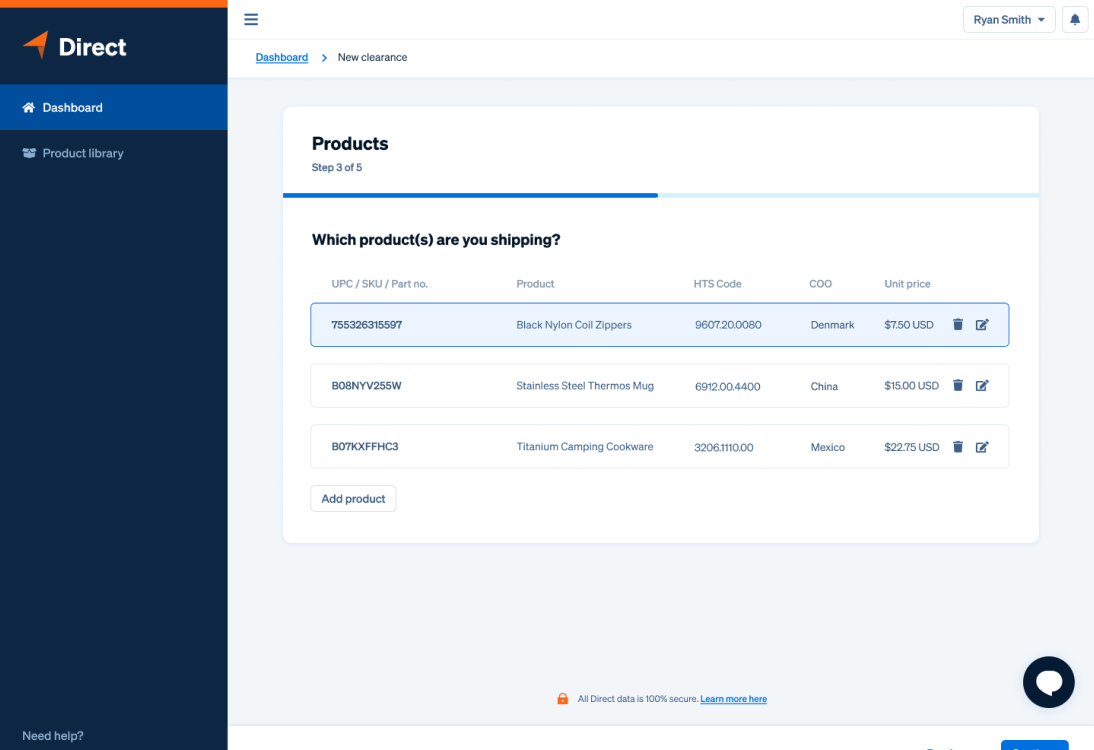

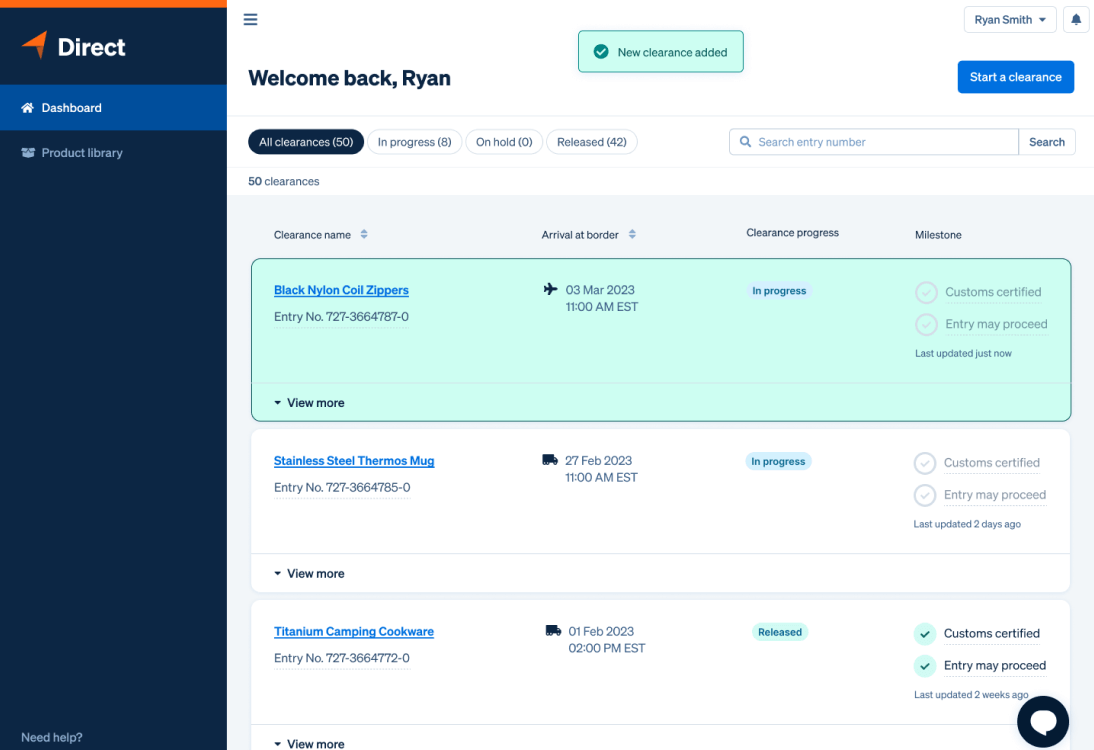

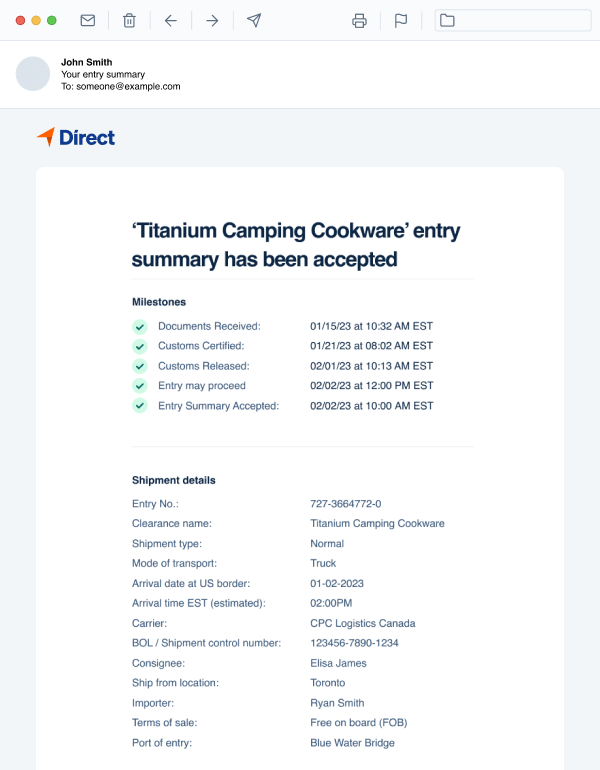

You can upload and update your documents and track progress in real-time, reducing supply chain disruptions through a seamless experience. Our intuitive, user-friendly dashboard empowers you with full visibility of your customs clearances.